Credit Repair Myths Debunked: Dividing Fact from Fiction

Credit Repair Myths Debunked: Dividing Fact from Fiction

Blog Article

A Comprehensive Guide to Just How Credit Rating Repair Service Can Transform Your Credit History

Comprehending the details of credit rating repair is vital for any individual looking for to enhance their financial standing. By resolving concerns such as settlement history and credit application, individuals can take proactive steps toward enhancing their credit report scores.

Comprehending Credit History

Comprehending credit history is vital for any individual looking for to improve their economic health and wellness and accessibility far better borrowing options. A credit report is a mathematical representation of an individual's creditworthiness, generally varying from 300 to 850. This score is created based upon the information included in an individual's credit rating report, which includes their credit background, arrearages, repayment background, and kinds of charge account.

Lenders use credit history to examine the danger related to lending money or extending credit history. Higher scores indicate reduced danger, commonly bring about much more beneficial car loan terms, such as reduced interest rates and greater credit scores restrictions. Alternatively, reduced credit report can cause greater rate of interest or rejection of credit history entirely.

A number of variables influence credit history, including repayment background, which represents about 35% of the rating, followed by credit report use (30%), size of credit rating (15%), kinds of credit score in operation (10%), and new debt inquiries (10%) Recognizing these elements can equip individuals to take workable steps to enhance their ratings, inevitably improving their financial possibilities and stability. Credit Repair.

Usual Debt Issues

Lots of individuals face common credit rating problems that can hinder their economic progression and impact their credit report scores. One prevalent problem is late repayments, which can significantly damage credit rankings. Also a solitary late settlement can stay on a debt report for a number of years, affecting future borrowing capacity.

Identification theft is another severe worry, potentially leading to illegal accounts appearing on one's credit rating record. Dealing with these common debt concerns is necessary to improving monetary health and wellness and establishing a solid credit history profile.

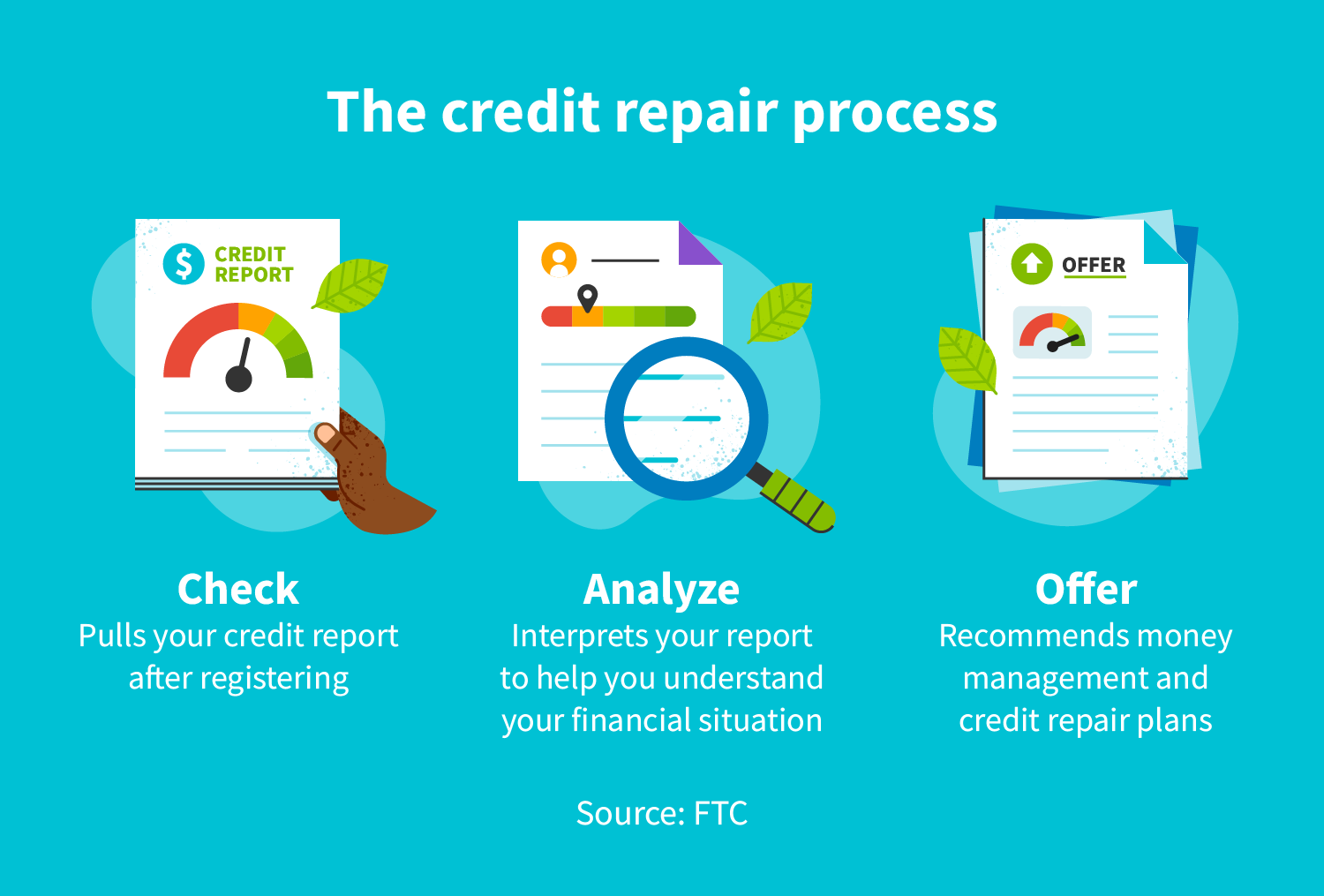

The Debt Fixing Process

Although credit scores repair service can seem challenging, it is a methodical process that individuals can undertake to enhance their credit history and remedy mistakes on their credit report reports. The very first step involves getting a copy of your credit record from the three major credit score bureaus: Experian, TransUnion, and Equifax. Evaluation these records thoroughly for mistakes or inconsistencies, such as incorrect account information or out-of-date info.

As soon as mistakes are determined, the following action is to challenge these mistakes. This can be done by calling the credit scores bureaus straight, supplying paperwork that sustains your claim. The bureaus are called for to examine disputes within 30 days.

Maintaining a regular payment history and managing credit rating utilization is additionally important throughout this procedure. Monitoring your debt frequently ensures continuous precision and helps track enhancements over time, enhancing the effectiveness of your debt repair efforts. Credit Repair.

Benefits of Credit History Repair Work

The advantages of credit repair service expand much past just improving one's credit history; they can significantly influence financial security and possibilities. By dealing with inaccuracies and unfavorable products on a debt record, individuals can boost their creditworthiness, making them much more eye-catching to lending institutions and banks. This improvement frequently leads to much better rate of interest on finances, lower costs for insurance, and boosted opportunities of approval for credit cards and home mortgages.

Furthermore, credit score repair service can promote accessibility to crucial solutions visit site that need a credit report check, such as renting a home or getting an utility solution. With a much healthier credit rating account, individuals might experience enhanced self-confidence in their economic decisions, permitting them to make larger acquisitions or financial investments that were formerly unreachable.

Along with tangible economic advantages, credit scores fixing promotes a feeling of empowerment. People take control of their financial future by actively managing their credit, bring about more informed options and greater economic proficiency. Generally, the benefits of credit repair work add to an extra secure monetary landscape, ultimately advertising long-term economic development and individual success.

Selecting a Debt Repair Work Service

Picking a credit fixing service needs cautious consideration to ensure that people get the support they require to boost their economic standing. Begin by looking into prospective companies, focusing on those with favorable customer evaluations and a proven record of success. Openness is crucial; a trusted service needs to plainly detail their timelines, procedures, and costs in advance.

Next, verify that the credit history repair work solution abide by the Credit history Fixing Organizations Act (CROA) This federal law protects customers from deceptive methods and sets standards for credit score repair work solutions. Stay clear of firms that make impractical guarantees, such as ensuring a particular rating increase or declaring they can eliminate all negative things from your report.

In Bonuses addition, consider the level of consumer support offered. A good credit score repair solution ought to supply customized support, allowing you to ask inquiries and obtain timely updates on your progression. Search for services that offer an extensive evaluation of your credit scores record and develop a customized technique tailored to your details circumstance.

Ultimately, choosing the right credit report repair solution can result in significant enhancements in your credit score, encouraging you to take control of your financial future.

Verdict

In verdict, effective credit report repair work methods can considerably improve credit score scores by resolving typical issues such as late repayments and mistakes. A detailed understanding of credit rating elements, incorporated with the involvement of reputable credit history repair service services, assists in the arrangement of unfavorable things and recurring development monitoring. Eventually, the effective renovation of credit history not just results in better lending terms yet also cultivates better financial opportunities and stability, emphasizing the value of proactive credit history administration.

By dealing with issues such as payment history and credit report application, individuals can take positive steps toward boosting their credit score ratings.Lenders utilize debt scores to evaluate the threat connected with providing original site money or prolonging credit.One more regular problem is high credit rating utilization, defined as the ratio of current credit history card equilibriums to complete readily available credit history.Although credit rating repair service can appear overwhelming, it is an organized procedure that people can embark on to boost their credit history ratings and fix errors on their debt records.Next, validate that the credit scores fixing solution complies with the Credit scores Fixing Organizations Act (CROA)

Report this page